High-grade copper and gold intersections extend known mineralisation at FireFly’s Green Bay by 650m

The furthest intersection returns 49m at 6.1% CuEq1 and remains open at depth; These results will form part of the Mineral Resource Estimate update set for this quarter

KEY POINTS

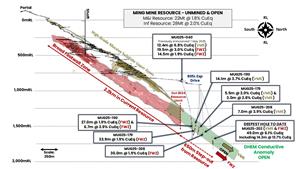

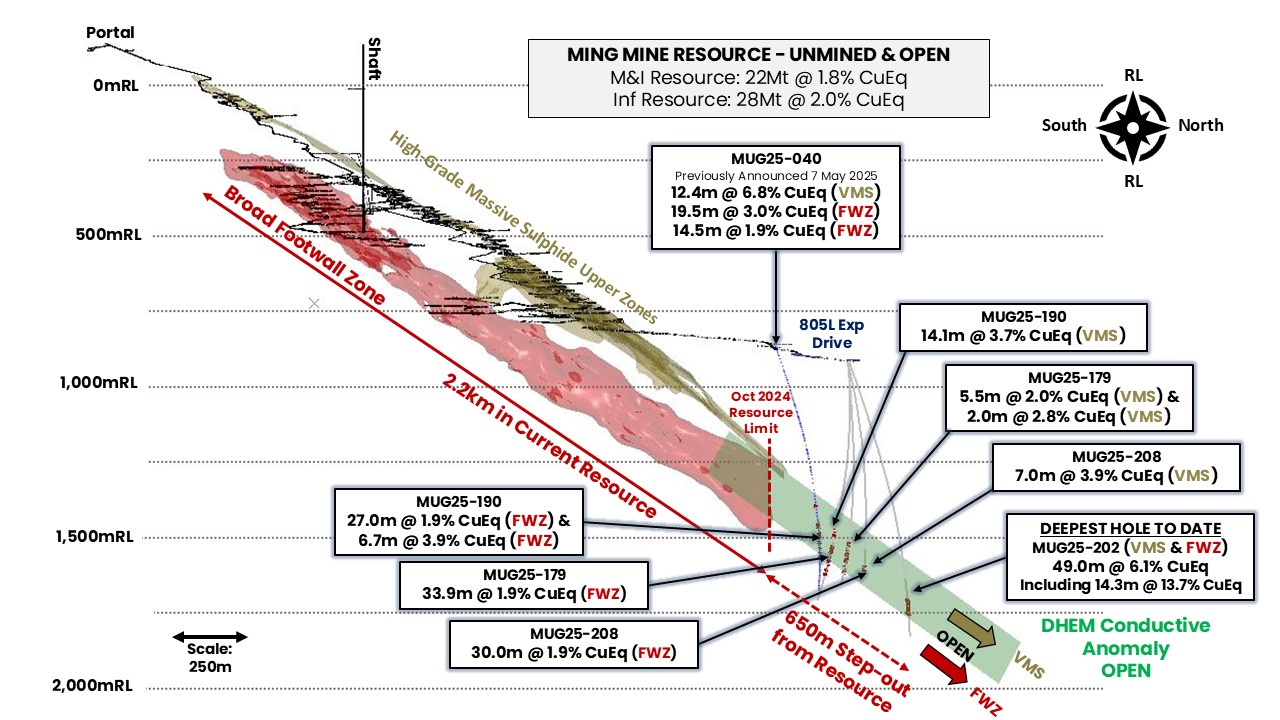

- Drilling from the end of the Ming mine exploration drive has extended the known mineralisation by 430m beyond previous drilling and more than 650m beyond the October 2024 Mineral Resource Estimate

-

The strength of the mineralisation (i.e. the combination of grade and width) appears to be increasing at depth with the furthest hole returning one of the best intersections drilled in the deposit to date:

-

49.0m @ 6.1% copper equivalent (CuEq)1 (4.9% Cu & 1.3g/t Au) in hole MUG25-202 (~39.2m true thickness), including

- 14.3m @ 13.7% CuEq (10.6% Cu & 3.2% Au)

-

49.0m @ 6.1% copper equivalent (CuEq)1 (4.9% Cu & 1.3g/t Au) in hole MUG25-202 (~39.2m true thickness), including

- Importantly, these drillholes confirm that the previously reported ~700m long downhole electromagnetic (DHEM) geophysical anomaly (see ASX announcement dated 7 May 2025) is the result of confirmed copper-gold bearing mineralisation. This anomaly indicates mineralisation is likely to continue well beyond this step-out hole

-

Other step-out holes demonstrate that the upper high-grade copper and gold rich Volcanogenic Massive Sulphide (VMS) zones continue, with key intersections including:

- 7.0m @ 3.9% CuEq (2.1% Cu & 1.9g/t Au) in hole MUG25-208 (~ true thickness)

-

14.1m @ 3.7% CuEq (0.9% Cu & 3.2g/t Au) in hole MUG25-190 (~ true thickness), including

- 1.8m @ 15.2% CuEq (1.8% Cu & 15.9g/t Au) and

- 4.4m @ 4.4% CuEq (1.8% Cu & 2.8g/t Au)

-

The drilling also confirms the presence of broad copper-rich Footwall Zone (FWZ) style copper mineralisation below the upper VMS zone. Intersections include:

- 33.9m @ 1.9% CuEq (1.8% Cu & 0.1g/t Au) in hole MUG25-179 (~ true thickness)

- 30.0m @ 1.9% CuEq (1.8% Cu & 0.1g/t Au) in hole MUG25-208 (~ true thickness)

- 27.0m @ 1.9% CuEq (1.8% Cu & 0.1g/t Au) in hole MUG25-190 (~ true thickness)

______________________________

1 Metal equivalent for drill results reported in this announcement have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Metallurgical recoveries have been set at 95% for copper, 85% for precious metals and 50% for zinc. CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038). In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and historical performance achieved at the Green Bay project whilst in operation.

- The current Mineral Resource Estimate for Green Bay totals 24.4Mt at 1.9% for 460Kt CuEq of Measured & Indicated Resources and 34.5Mt at 2.0% for 690Kt CuEq of Inferred Resources (see ASX announcement dated 29 October 2024)

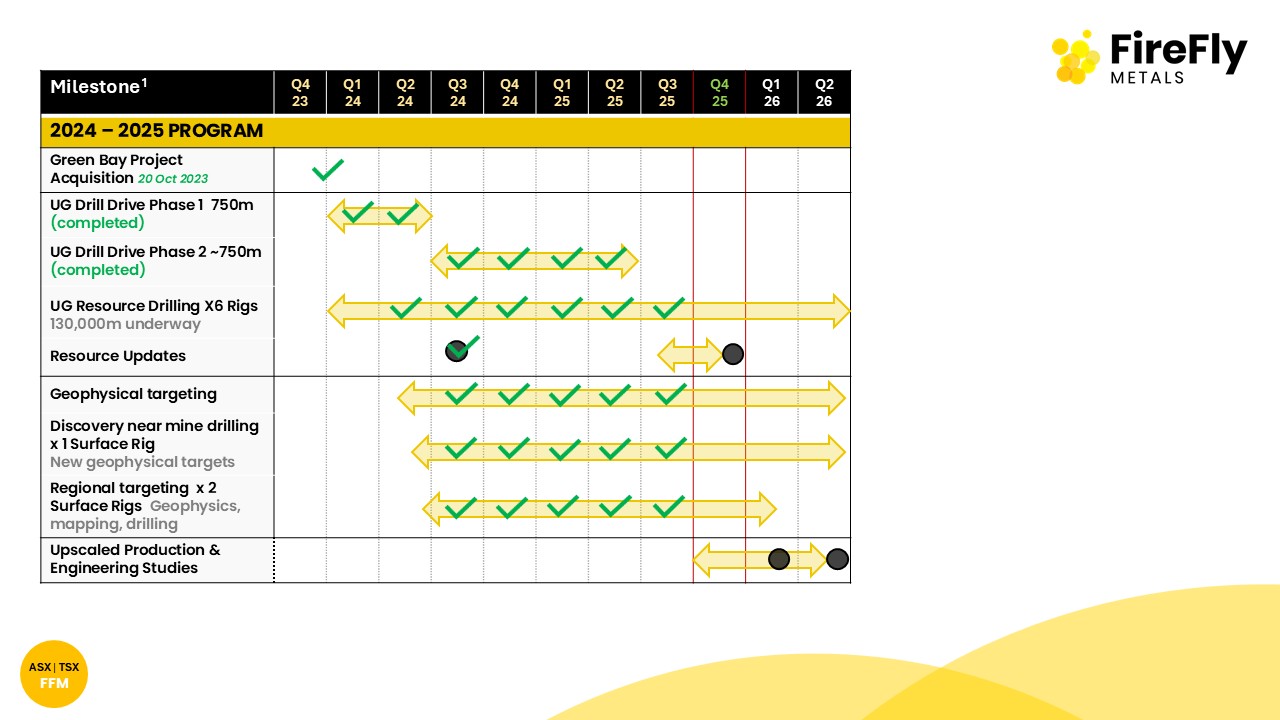

- Eight diamond rigs continue operating (six underground and two on surface) to upgrade the current Mineral Resource, extend known mineralisation and make new regional discoveries

- Regional exploration is well underway, with drill rigs systematically testing conductive geophysical anomalies in the central Green Bay leases (see ASX announcement dated 24 July 2025). A VTEM survey is being completed over the Company’s Tilt Cove Project

-

FireFly has a strong balance sheet with cash and liquid investments of ~A$145M2 following successful completion of the recent equity raise. These funds will be used to accelerate exploration activities and complete the feasibility study on the upscaled Green Bay Project

FireFly Managing Director Steve Parsons said: “These results are truly world-class, with widths and grades which any copper miner would be delighted to have.

“To extend the known mineralisation by 650m beyond the Mineral Resource with such a spectacular intersection as 49m at 6.1% CuEq demonstrates the exceptional growth outlook at Green Bay and shows why it is one of the best undeveloped copper projects in the world. The mineralisation remains open, and we are continuing to drill in pursuit of more growth.

“The spectacular results in this announcement combined with the recent infill drill results set the scene for a Mineral Resource update later this quarter.”

PERTH, Australia, Oct. 15, 2025 (GLOBE NEWSWIRE) -- FireFly Metals Ltd (ASX: FFM, TSX: FFM) (Company or FireFly) is pleased to announce exceptional drill results which extend the known mineralisation by more than 650m beyond the Mineral Resource at its Green Bay Copper-Gold Project.

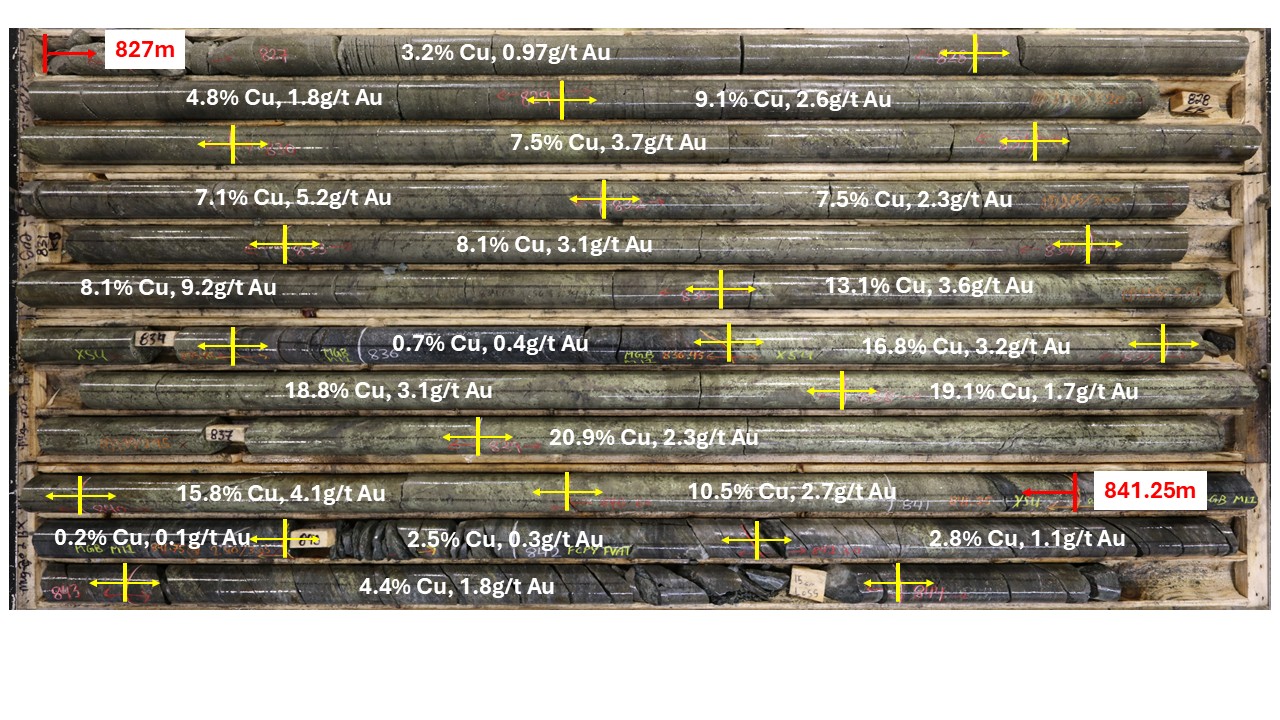

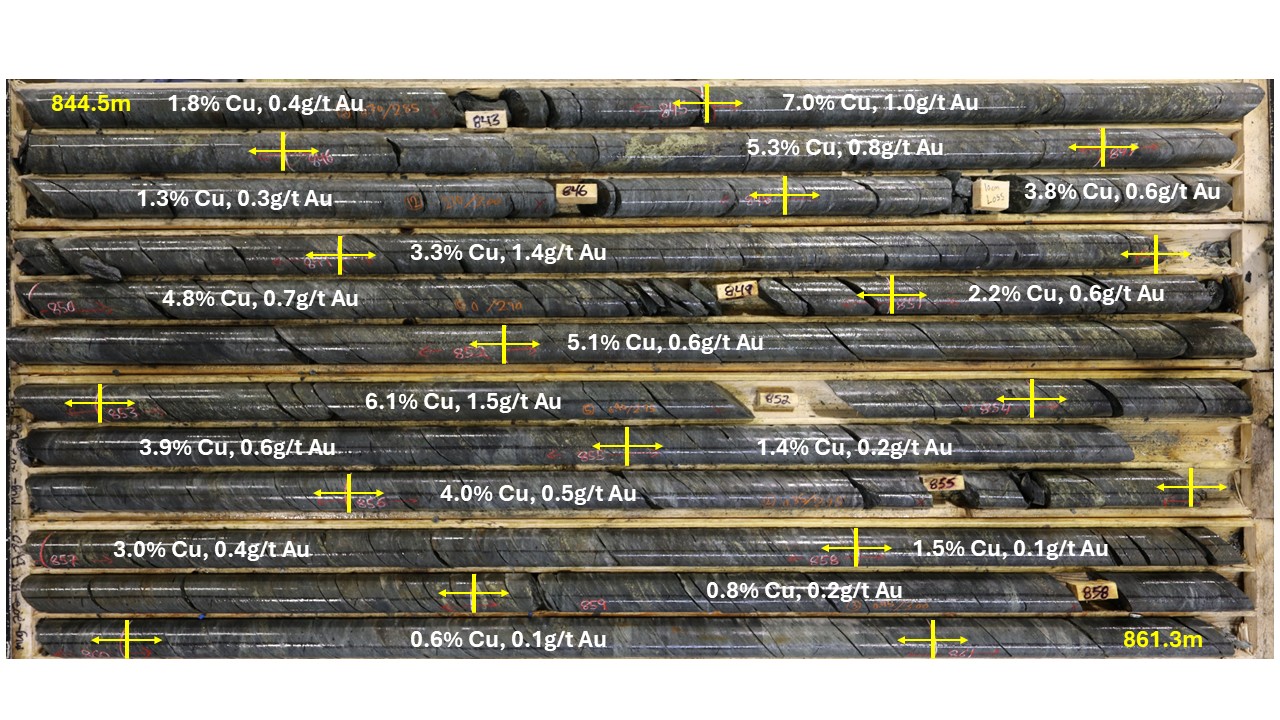

The furthest drillhole recently completed from the northern end of the 805L exploration drive intersected 49.0m @ 6.1% CuEq (~39.2m true thickness). This included an internal massive sulphide zone grading a significant 14.3m @ 13.7% CuEq.

This is one of the best intersections ever recorded at the Ming deposit within Green Bay and provides more firm evidence that the grade of mineralisation is increasing at depth.

The step-out drilling in this announcement extends the mineralisation more than 650m beyond the October 2024 Mineral Resource Estimate. These holes will form an important part of the updated estimate planned for later this quarter.3

The Mineral Resource Estimate currently stands at 24.4Mt @ 1.9% for 460Kt CuEq of Measured and Indicated Resources and a further 34.5Mt @ 2.0% for 690Kt CuEq of Inferred Resources.4

______________________________

2 Cash, receivables and liquid investment position at 30 June 2025, plus A$10 million gross proceeds received from the Share Purchase Plan first announced on 5 June 2025 and completed on 14 July 2025, plus net proceeds of ~A$26.6 million from the second tranche of the institutional placement first announced on 5 June 2025 and completed on 3 September 2025.

3 Timeframes are indicative and may be subject to change.

4 See ASX announcement dated 29 October 2024.

There are two distinct styles of mineralisation at the Ming underground mine at Green Bay. One comprises the upper copper-gold rich Volcanogenic Massive Sulphide (VMS) lenses. The VMS lenses sit above a broad copper stringer zone known as the Footwall Zone (FWZ). The step-out drilling confirms both styles of mineralisation continue at depth and remain open.

Strong copper and gold mineralisation was also defined in the upper VMS zones with intersections including 7.0m @ 3.9% CuEq and 14.1m @ 3.7% CuEq which included an internal gold-dominated zone grading 1.8m @ 15.9g/t Au and 1.8%Cu. The FWZ mineralisation identified exhibited consistent grades and widths with results including 33.9m @ 1.9% CuEq and 30.0m @ 1.9% CuEq.

Importantly these drillholes confirm that the 700m long downhole electromagnetic (DHEM) geophysical anomaly reported in the ASX announcement dated 7 May 2025 (Figure 1) is the result of copper-gold bearing sulphide mineralisation. This anomaly indicates mineralisation is likely to continue well beyond the step-out hole reported in this announcement.

The extensive six-rig underground drill campaign continues at the Ming Mine with the dual objectives of growing the current Mineral Resource and, most importantly, upgrading more of the Inferred Resources to the comparatively more valuable Measured and Indicated (M&I) Mineral Resource categories.

Figure 1: Long section through the Green Bay Ming underground mine showing the location of select drill results from this announcement showing the 650m step-out from the previously released October 2024 Mineral Resource Estimate. The green shape is a modelled DHEM anomaly demonstrating the mineralisation remains open beyond this deepest drill hole (see ASX announcement dated 7 May 2025 for further details). Drill assays >0.5% copper are shown in red. Refer to Appendix B for all drill results and locations in this ASX announcement.

Regionally, exploration programmes are also well underway, following the North American summer break period, with two diamond drill rigs now on site and ready to accelerate the regional discovery campaign. Geophysical data collection continues, with a detailed helimagnetic survey being conducted over the central Green Bay leases. A comprehensive VTEM survey is being completed over the entire 115km2 of the adjacent Tilt Cove Project to the east of the Ming Mine. The new geophysical data is expected to be available in the coming weeks. The rigs will systematically test geophysical anomalies generated by this new data and the Company’s previous airborne VTEM surveys.

FireFly is well funded to accelerate its growth campaign and engineering studies with a recent well supported equity raising which has strengthened the Company’s balance sheet, with cash and liquid investments of ~A$145 million.5

______________________________

5 Cash, receivables and liquid investment position at 30 June 2025, plus A$10 million gross proceeds received from the Share Purchase Plan first announced on 5 June 2025 and completed on 14 July 2025, plus net proceeds of ~A$26.6 million from the second tranche of the institutional placement first announced on 5 June 2025 and completed on 3 September 2025.

About the Drilling Results

Drilling at the Ming underground copper-gold mine recommenced following the acquisition of the Green Bay Copper-Gold Project by FireFly in October 2023. In total, FireFly has completed 245 underground holes for a total of ~126,877m of underground diamond drilling to 11 October 2025.

This announcement contains the results of 4 drill holes. The drilling results reported in this announcement are step-out holes targeting down-plunge extensions of the Ming Mine mineralisation drilled from the northern extent of the 805L exploration drive. Logging and analysis of additional drill holes is ongoing, and further details will be reported as results are received.

There are two distinct styles of mineralisation present at the Green Bay Ming Mine, consisting of a series of upper copper-gold rich VMS lenses underlain by a broad copper-rich stringer zone, known as the Footwall Zone (or FWZ).

The Footwall Zone is extensive, with the copper stringer mineralisation observed over thicknesses of ~150m and widths exceeding 200m. The known strike of the mineralisation defined to date is 2.3km and it remains open down-plunge.

Six drill rigs are currently operating underground, with the focus split between both step-out extension and exploration (two rigs) and infill Resource conversion drilling (four rigs).

Significant assay results are presented in Appendix B of this announcement.

Step-out Drilling from the 805L Exploration Drive

FireFly commenced mining the 805L exploration drive in late 2023. These are the first results received for the holes drilled at the most northern end of the 805L (Crosscuts 5 and 6).

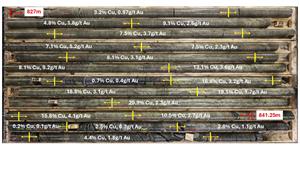

Hole MUG25-202 Intersected thick and continuous mineralisation consisting of copper-gold VMS zone immediately transitioning into FWZ stringer-style mineralisation (Figure 2). This hole is the furthest drilling down-plunge in the deposit to date and is more than 650m from the boundary of the October 2024 Mineral Resource Estimate. Key intersections include:

-

49m @ 4.9% Cu, 1.3g/t Au, 13.4g/t Ag, 0.85% Zn (6.1% CuEq) from 820m (VMS merging into FWZ-style mineralisation) and includes a higher grade zone of (~39.2m true thickness):

- 14.3m @ 10.6% Cu, 3.2g/t Au, 33.4g/t Ag, 1.67% Zn (13.7% CuEq) from 827m (VMS-style)

Figure 2: Core photographs for drillhole MUG25-202, showing the upper VMS (827m-841.25m) that grades 14.3m @ 13.7% CuEq and the adjacent broad FWZ stringer-style mineralisation. This is part of the broader step-out intersection of 49.0m @ 6.1% CuEq.

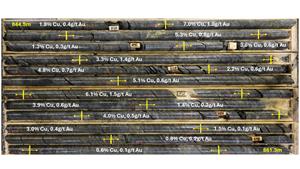

Hole MUG25-208 contained an upper copper and gold rich VMS zone with a thick FWZ approximately 20 metres below the VMS zone. Key intersections include (All ~ true thickness):

- 7.0m @ 2.1% Cu, 1.9g/t Au, 11.5g/t Ag, 1.15% Zn (3.9% CuEq) from 641m (VMS-style) and

-

30.0m @ 1.8% Cu, 0.1g/t Au, 1.5g/t Ag, 0.02% Zn (1.9% CuEq) from 668m (FW Stringer-style)

Hole MUG25-179 intersected two VMS zones separated by a post-mineral mafic dyke. FWZ style stringer mineralisation commenced ~12m beneath the VMS zones. Key intersections include (All ~ true thickness):

- 5.5m @ 1.0% Cu, 0.9g/t Au, 9.2g/t Ag, 0.8% Zn (2.0% CuEq) from 604m (VMS-style) and

- 2.0m @ 1.4% Cu, 1.4g/t Au, 10.9g/t Ag, 1.2% Zn (2.8% CuEq) from 612m (VMS-style) and

- 33.9m @ 1.8% Cu, 0.1g/t Au, 1.9g/t Ag, 0.02% Zn (1.9% CuEq) from 636m (FW Stringer-style) and

-

4m @ 1.5% Cu, 0.2g/t Au, 2.4g/t Ag, 0.12% Zn (1.7% CuEq) from 695m (FW Stringer-style)

Hole MUG25-190 returned a thick gold-dominated VMS intersection at the margins of the channel underlain by multiple zones footwall-style stringer mineralisation. Key intersections include (All ~ true thickness):

-

14.1m @ 0.9% Cu, 3.2g/t Au, 11.9g/t Ag, 0.74% Zn (3.7% CuEq) from 567.1m (VMS-style) including:

- 1.8m @ 1.8% Cu, 15.9g/t Au, 39.4g/t Ag, 0.78% Zn (15.2% CuEq) from 567.1m

- 4.4m @ 1.8% Cu, 2.8g/t Au, 18.9g/t Ag, 1.1% Zn (4.4% CuEq) from 574.1m

- 27.0m @ 1.8% Cu, 0.1g/t Au, 1.9g/t Ag, 0.08% Zn (1.9% CuEq) from 614m (FW Stringer-style) and

- 6.7m @ 3.6% Cu, 0.2g/t Au, 3.7g/t Ag, 0.3% Zn (3.9% CuEq) from 663.3m (FW Stringer-style)and

- 5m @ 1.3% Cu, 0.1g/t Au, 1.2g/t Ag, 0.16% Zn (1.4% CuEq) from 690.1m (FW Stringer-style) and

-

6.8m @ 1.5% Cu, 0.1g/t Au, 1.4g/t Ag, 0.07% Zn (1.7% CuEq) from 708.2m (FW Stringer-style)

Forward Work Plans

Near-term drilling activities at the Green Bay Copper-Gold Project will continue to focus on three key areas: Upgrading the Mineral Resource (with infill drilling results), Mineral Resource Growth, and New Discoveries from both underground and surface. As at 11 October 2025, the Company had completed ~126,877m of underground diamond drilling. Six underground rigs will continue to advance the underground Mineral Resource growth and extension activities.

Green Bay (Ming Mine) Resource Growth

The low-cost Mineral Resource growth strategy is underpinned by the 805L exploration drill drive at the Ming Mine. The second phase of 805L exploration drive has been completed, providing locations for both infill drilling and further down-plunge Mineral Resource extension. The exploration development is positioned to enable utilisation in potential future upscaled mining operations. Drilling is ongoing with further results due in the coming weeks.

Development of additional platforms for further ongoing exploration and infill drilling will continue at Ming Mine throughout 2025.

Upgrading the Mineral Resource Estimate remains a key priority for the Company’s plans to resume upscaled mining at Green Bay. Infill drilling will upgrade the Inferred Resource (34.5Mt @ 2.0% CuEq) to the higher quality Measured and Indicated (M&I) Resource category which currently stands at 24.4Mt @ 1.9% CuEq.6

Based on results to date, it is likely that the amount of mineralisation classified as M&I will increase in the Mineral Resource Estimate update planned to be released later in the current quarter. This is important because only M&I Mineral Resources can be considered in future feasibility studies.

Green Bay (Ming Mine) Upscaled Project Development

Economic evaluations for the rescaled resumption of production at Green Bay are continuing with the first preliminary study planned for completion in Q1 2026. The study will be underpinned by the updated Mineral Resource Estimate planned to be released later this quarter.

Following the announcement of metallurgical testwork results in August (see ASX announcement dated 5 August 2025, in which it was reported that copper recoveries of 98% were returned and preliminary work on gold extraction demonstrated gold recovery of up to 85%), gold forms an important economic component of the deposit with, so far, 550koz of gold as a byproduct in the current Mineral Resource.

Various scenarios for an upscaled restart to operations are being evaluated. With the huge success of the drilling programs to date, the Company wishes to avoid unnecessarily limiting the size of any future potential upscaled mining operation until it has completed the next phase of growth drilling.

Following the recent conditional release from further Environmental Assessment by the Province of Newfoundland and Labrador for a start-up mining and processing operation (see ASX announcement dated 5 August 2025), the Company has now commenced the application for permits to commence early works and construction. The Company intends to commence selective low-cost seasonal early works in the coming months to prepare the Project for future development and construction.

Green Bay (Ming Mine) Regional Discovery

Regional exploration is underway with two surface drill rigs testing high-priority targets across the Company’s 346km2 surface exploration claims.

One of the drill rigs will continue to test high-priority targets close to the Ming Mine. The second drill rig will systematically test early-stage greenfields targets generated by airborne VTEM and magnetic surveys completed in 2024 and 2025.

FireFly has continued to invest in regional-scale geophysics as a key exploration tool. The Company is completing a detailed VTEM survey over the 115km2 Tilt Cove Project. A detailed helicopter magnetic survey is also being completed over the central Green Bay leases.

______________________________

6 Refer to ASX announcement dated 29 October 2024 and Appendix A of this announcement for further details on the Mineral Resource Estimate.

Funding and Corporate Activities

FireFly is well funded to complete its large-scale accelerated growth campaign at Green Bay. As originally announced on 5 June 2025, the Company has undertaken and completed an ~A$98.1M7 equity raising in conjunction with a A$10M Share Purchase Plan. As a result, the Company has strengthened its balance sheet, with cash and liquid investments of ~A$145 million8.

Figure 3: Key 2024-2025 milestones for the Green Bay Copper-Gold Project.

1 Timelines are indicative and may be subject to change.

|

Steve Parsons Managing Director FireFly Metals Ltd +61 8 9220 9030 |

Jessie Liu-Ernsting Chief Development Officer FireFly Metals Ltd +1 709 800 1929 |

Media Paul Armstrong Read Corporate +61 8 9388 1474 |

______________________________

7 See ASX announcement dated 11 July 2025.

8 Cash, receivables and liquid investment position at 30 June 2025, plus A$10 million gross proceeds received from the Share Purchase Plan first announced on 5 June 2025 and completed on 14 July 2025, plus net proceeds of ~A$26.6 million from the second tranche of the institutional placement first announced on 5 June 2025 and completed on 3 September 2025.

ABOUT FIREFLY METALS

FireFly Metals Ltd (ASX, TSX: FFM) is an emerging copper-gold company focused on advancing the high-grade Green Bay Copper-Gold Project in Newfoundland, Canada. The Green Bay Copper-Gold Project currently hosts a Mineral Resource prepared and disclosed in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) of 24.4Mt of Measured and Indicated Resources at 1.9% for 460Kt CuEq and 34.5Mt of Inferred Resources at 2% for 690Kt CuEq. The Company has a clear strategy to rapidly grow the copper-gold Mineral Resource to demonstrate a globally significant copper-gold asset. FireFly has commenced a 130,000m diamond drilling program.

FireFly holds a 70% interest in the high-grade Pickle Crow Gold Project in Ontario. The current Inferred Resource stands at 11.9Mt at 7.2g/t for 2.8Moz gold, with exceptional discovery potential on the 500km2 tenement holding.

The Company also holds a 90% interest in the Limestone Well Vanadium-Titanium Project in Western Australia.

For further information regarding FireFly Metals Ltd please visit the ASX platform (ASX:FFM) or the Company’s website www.fireflymetals.com.au or SEDAR+ at www.sedarplus.ca.

COMPLIANCE STATEMENTS

Mineral Resources Estimate – Green Bay Project

The Mineral Resource Estimate for the Green Bay Project referred to in this announcement and set out in Appendix A was first reported in the Company’s ASX announcement dated 29 October 2024, titled 'Resource increases 42% to 1.2Mt of contained metal at 2% Copper Eq' and is also set out in the Technical Reports for the Ming Copper Gold Mine titled 'National Instrument 43-101 Technical Report, FireFly Metals Ltd., Ming Copper-Gold Project, Newfoundland' with an effective date of 29 November 2024 and the Little Deer Copper Project, titled 'Technical Report and Updated Mineral Resource Estimate of the Little Deer Complex Copper Deposits, Newfoundland, Canada' with an effective date of 26 June 2024, each of which is available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Mineral Resources Estimate – Pickle Crow Project

The Mineral Resource Estimate for the Pickle Crow Project referred to in this announcement was first reported in the Company’s ASX announcement dated 4 May 2023, titled 'High-Grade Inferred Gold Resource Grows to 2.8Moz at 7.2g/t' and is also set out in the Technical Report for the Pickle Crow Project, titled 'NI 43-101 Technical Report Mineral Resource Estimate Pickle Crow Gold Project, Ontario, Canada' with an effective date of 29 November 2024, as amended on 11 June 2025, available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Metal equivalents for Mineral Resource Estimates

Metal equivalents for Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Individual Mineral Resource grades for the metals are set out in Appendix A of this announcement. Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% on the basis of historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase precious metal recoveries.

In the opinion of the Company, all elements included in the metal equivalent calculations have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, the Company’s operational experience and, where relevant, historical performance achieved at the Green Bay project whilst in operation.

Metal equivalents for Exploration Results

Metal equivalents for Exploration Results have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Individual grades for the metals are set out in Appendix B of this announcement.

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% based on historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase recoveries. Zinc recovery is applied at 50% based on historical processing and potential upgrades to the mineral processing facility.

In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and the Company’s operational experience.

Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038).

Exploration Results

Previously reported Exploration Results at the Green Bay Project referred to in this announcement were first reported in accordance with ASX Listing Rule 5.7 in the Company’s ASX announcements dated 31 August 2023, 11 December 2023, 16 January 2024, 4 March 2024, 21 March 2024, 29 April 2024, 19 June 2024, 3 September 2024, 16 September 2024, 3 October 2024, 10 December 2024 and 12 February 2025.

Original announcements

FireFly confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that, in the case of estimates of Mineral Resources, all material assumptions and technical parameters underpinning the Mineral Resource Estimates in the original announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons’ and Qualified Persons’ findings are presented have not been materially modified from the original market announcements.

COMPETENT PERSON AND QUALIFIED PERSON STATEMENTS

The information in this announcement that relates to new Exploration Results is based on and fairly represents information compiled by Mr Darren Cooke, a Competent Person who is a member of the Australasian Institute of Geoscientists. Mr Cooke is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Cooke has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Cooke consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

All technical and scientific information in this announcement has been reviewed and approved by Group Chief Geologist, Mr Juan Gutierrez BSc, Geology (Masters), Geostatistics (Postgraduate Diploma), who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr Gutierrez is a Qualified Person as defined in NI 43-101. Mr Gutierrez is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Gutierrez has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Qualified Person as defined in NI 43-101. Mr Gutierrez consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

FORWARD-LOOKING INFORMATION

This announcement may contain certain forward-looking statements and projections, including statements regarding FireFly’s plans, forecasts and projections with respect to its mineral properties and programs. Forward-looking statements may be identified by the use of words such as “may”, “might”, “could”, “would”, “will”, “expect”, “intend”, “believe”, “forecast”, “milestone”, “objective”, “predict”, “plan”, “scheduled”, “estimate”, “anticipate”, “continue”, or other similar words and may include, without limitation, statements regarding plans, strategies and objectives.

Although the forward-looking statements contained in this announcement reflect management’s current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements and projections are estimates only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors many of which are beyond the control of the Company, which may include changes in commodity prices, foreign exchange fluctuations, economic, social and political conditions, and changes to applicable regulation, and those risks outlined in the Company’s public disclosures.

The forward-looking statements and projections are inherently uncertain and may therefore differ materially from results ultimately achieved. For example, there can be no assurance that FireFly will be able to confirm the presence of Mineral Resources or Ore Reserves, that FireFly’s plans for development of its mineral properties will proceed, that any mineralisation will prove to be economic, or that a mine will be successfully developed on any of FireFly’s mineral properties. The performance of FireFly may be influenced by a number of factors which are outside of the control of the Company, its directors, officers, employees and contractors. The Company does not make any representations and provides no warranties concerning the accuracy of any forward-looking statements or projections, and disclaims any obligation to update or revise any forward-looking statements or projections based on new information, future events or circumstances or otherwise, except to the extent required by applicable laws.

APPENDIX A

Green Bay Copper-Gold Project Mineral Resources

Ming Deposit Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | (‘000 t) | (g/t) | (‘000 oz) | (g/t) | (‘000 oz) | (%) | ||

| Measured | 4.7 | 1.7 | 80 | 0.3 | 40 | 2.3 | 340 | 1.9 |

| Indicated | 16.8 | 1.6 | 270 | 0.3 | 150 | 2.4 | 1,300 | 1.8 |

| TOTAL M&I | 21.5 | 1.6 | 340 | 0.3 | 190 | 2.4 | 1,600 | 1.8 |

| Inferred | 28.4 | 1.7 | 480 | 0.4 | 340 | 3.3 | 3,000 | 2.0 |

Little Deer Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | (‘000 t) | (g/t) | (‘000 oz) | (g/t) | (‘000 oz) | (%) | ||

| Measured | - | - | - | - | - | - | - | - |

| Indicated | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| TOTAL M&I | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| Inferred | 6.2 | 1.8 | 110 | 0.1 | 10 | 2.2 | 430 | 1.8 |

GREEN BAY TOTAL MINERAL RESOURCE ESTIMATE

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) | Grade | Metal | Grade | Metal | Grade | Metal | Grade | |

| (%) | (‘000 t) | (g/t) | (‘000 oz) | (g/t) | (‘000 oz) | (%) | ||

| Measured | 4.7 | 1.7 | 80 | 0.3 | 45 | 2.3 | 340 | 1.9 |

| Indicated | 19.7 | 1.7 | 330 | 0.2 | 154 | 2.6 | 1,600 | 1.9 |

| TOTAL M&I | 24.4 | 1.7 | 400 | 0.3 | 199 | 2.5 | 2,000 | 1.9 |

| Inferred | 34.6 | 1.7 | 600 | 0.3 | 348 | 3.1 | 3,400 | 2.0 |

- FireFly Metals Ltd Mineral Resource Estimates for the Green Bay Copper-Gold Project, incorporating the Ming Deposit and Little Deer Complex, are prepared and reported in accordance with the JORC Code 2012 and NI 43-101.

- Mineral Resources have been reported at a 1.0% copper cut-off grade.

- Metal equivalents for the Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Metallurgical recoveries have been set at 95% for copper and 85% for both gold and silver. Copper equivalent was calculated based on the formula: CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

- Totals may vary due to rounding.

APPENDIX B – Significant Intersection Table

Collar co-ordinates and orientation are listed in the local Ming Mine grid, which is rotated +35 degrees from NAD83 True North. Significant intersections reported are those above a 1% copper cut-off or 0.5g/t gold, and contain a maximum of 6 metres of internal waste. Please refer to the compliance statements for further details on parameters used in the copper equivalent calculation. All results are approximate true thickness unless noted.

|

Hole Number |

Easting |

Northing |

RL |

Azi |

Dip |

Drilled Length (m) |

From (m) |

To (m) |

Width (m) |

Assay |

CuEq % |

|||

| Cu % | Au g/t | Ag g/t | Zn % | |||||||||||

| MUG25-179 | 1206.9 | 2355.8 | -917.8 | 0 | -84 | 745 | 604.0 | 609.5 | 5.5 | 1.03 | 0.9 | 9.2 | 0.81 | 1.97 |

| 612.0 | 614.0 | 2.0 | 1.39 | 1.4 | 10.9 | 1.22 | 2.78 | |||||||

| 626.0 | 628.6 | 2.6 | 1.10 | 0.4 | 2.0 | 0.03 | 1.44 | |||||||

| 636.0 | 669.9 | 33.9 | 1.83 | 0.1 | 1.9 | 0.02 | 1.93 | |||||||

| 695.0 | 699.0 | 4.0 | 1.52 | 0.2 | 2.4 | 0.12 | 1.70 | |||||||

| MUG25-190 | 1255.4 | 2355.8 | -918.4 | 10 | -85 | 800 | 567.1 | 581.2 | 14.1 | 0.86 | 3.2 | 11.9 | 0.74 | 3.72 |

| Including | 567.1 | 568.9 | 1.8 | 1.75 | 15.9 | 39.4 | 0.78 | 15.22 | ||||||

| Including | 574.1 | 578.5 | 4.4 | 1.84 | 2.8 | 18.9 | 1.07 | 4.42 | ||||||

| 614.0 | 641.0 | 27.0 | 1.80 | 0.1 | 1.9 | 0.08 | 1.93 | |||||||

| 652.2 | 654.5 | 2.4 | 2.25 | 0.2 | 2.2 | 0.01 | 2.47 | |||||||

| 663.3 | 670.0 | 6.7 | 3.64 | 0.2 | 3.7 | 0.30 | 3.90 | |||||||

| 690.1 | 695.0 | 5.0 | 1.28 | 0.1 | 1.2 | 0.16 | 1.37 | |||||||

| 708.2 | 715.0 | 6.8 | 1.54 | 0.1 | 1.4 | 0.07 | 1.66 | |||||||

| MUG25_202 | 1255.5 | 2355.8 | -916.9 | 352 | -69 | 942 | 820.0 | 869.0 | 49.0 39.2 TW | 4.87 | 1.3 | 13.4 | 0.85 | 6.14 |

| 827.0 | 841.3 | 14.3 11.4 TW |

10.60 | 3.2 | 33.4 | 1.67 | 13.73 | |||||||

| MUG25-208 | 1206.9 | 2355.8 | -917.0 | 2.0 | -76 | 717 | 630.9 | 641.0 | 10.1 | 0.33 | 0.5 | 6.2 | 5.27 | 1.56 |

| 641.0 | 648.1 | 7.0 | 2.10 | 1.9 | 11.5 | 1.15 | 3.93 | |||||||

| 668.0 | 698.0 | 30.0 | 1.77 | 0.1 | 1.5 | 0.02 | 1.86 | |||||||

APPENDIX C – JORC CODE, 2012 EDITION

Table 1

Section 1 - Sampling Techniques and Data (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

The following steps are completed during the core logging procedure:

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 - Reporting of Exploration Results (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

|

|

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralisation widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

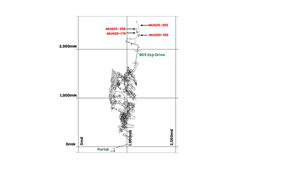

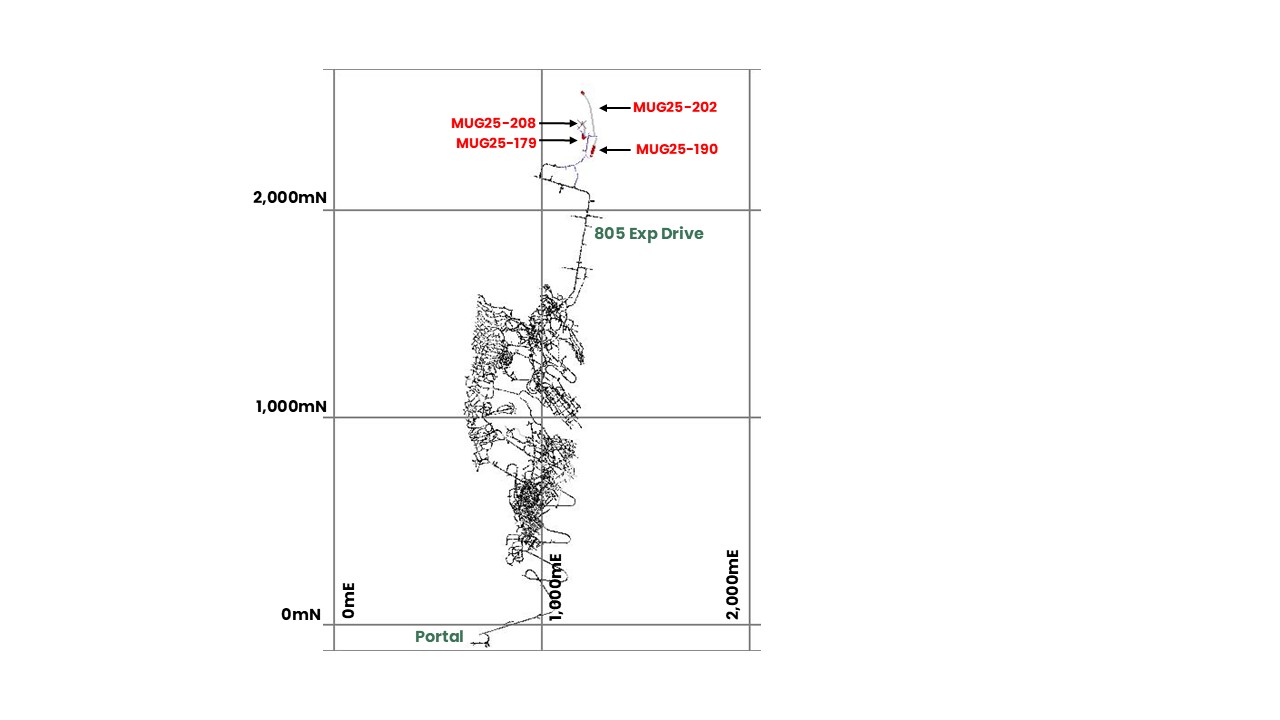

Plan view of drilling in this announcement

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/b3f9a882-6b65-47c5-b8f9-2f6299ab5a0e

https://www.globenewswire.com/NewsRoom/AttachmentNg/e236e747-9204-462c-aaad-0eee48b71504

https://www.globenewswire.com/NewsRoom/AttachmentNg/c2d119f9-7c2f-4a15-9531-baa377268e60

https://www.globenewswire.com/NewsRoom/AttachmentNg/d080e9ef-8b75-41aa-9aad-00a2f8b7f401

https://www.globenewswire.com/NewsRoom/AttachmentNg/f25c6eb4-6d58-42d6-bfba-84bcc63ecb1c

Figure 1

Long section through the Green Bay Ming underground mine showing the location of select drill results from this announcement showing the 650m step-out from the previously released October 2024 Mineral Resource Estimate. The green shape is a modelled DHEM anomaly demonstrating the mineralisation remains open beyond this deepest drill hole (see ASX announcement dated 7 May 2025 for further details). Drill assays >0.5% copper are shown in red. Refer to Appendix B for all drill results and locations in this ASX announcement.

Figure 2

Core photographs for drillhole MUG25-202, showing the upper VMS (827m-841.25m) that grades 14.3m @ 13.7% CuEq and the adjacent broad FWZ stringer-style mineralisation. This is part of the broader step-out intersection of 49.0m @ 6.1% CuEq.

Figure 2

Core photographs for drillhole MUG25-202, showing the upper VMS (827m-841.25m) that grades 14.3m @ 13.7% CuEq and the adjacent broad FWZ stringer-style mineralisation. This is part of the broader step-out intersection of 49.0m @ 6.1% CuEq.

Figure 3

Key 2024-2025 milestones for the Green Bay Copper-Gold Project. 1. Timelines are indicative and may be subject to change.

Figure 4

Plan view of drilling in this announcement

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.